Currently, you may only purchase a comprehensive car insurance policy (also known as a first-party policy) on RHB Insurance Online and Mobile App which provide the following coverage:

- Death or injury to other parties

- Damage to other parties’ property

- Loss/damage to your car due to theft or fire

- Damage to your car due to an accident

If you wish to purchase another type of car insurance coverage (i.e Third Party, Third Party Fire and Theft), you can contact us through the following channels:

- Meet our authorised intermediary (i.e Agent, General Insurance Specialist)

- Visit any of our RHB Insurance and Bank branches, click here for more detail

- Call 1300 220 007

- WhatsApp +6012 6031978

- Email us at rhbi.general@rhbgroup.com

You can contact us through the following channels:

- Web portal: Click on the “Emergency assistance” button on https://rhbinsurance.com.my/ or on RHB Insurance mobile app. Alternatively, click here

- Call our RHB Roadside Assistance hotline: 1300 880 881

RHB Private Car Insurance provides insurance against liabilities to other parties for injury or death, damage to other parties’ property and accidental or fire damage to your car or theft of your car. Our key benefits include:

- Instant 10% rebate via online and mobile application

- Enjoy up to 40% discount on car insurance premium with Motor Saver

- Free 24/7 emergency roadside assistance

- Immediate claim payouts of up to RM10,000 for unexpected natural disaster, click here for more information

- Option for car insurance excess to reduce the premium

- Option for an agreed value upon loss/damage of your car

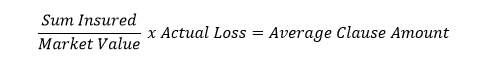

If the sum insured of your car is less than the market value (under-insured) at the time of the loss, we will apply the Average Clause which means we will only bear part of the loss in proportion to the difference between the market value and the sum insured as per the formula below:

The balance will be borne by you. This will only apply if the under-insurance amount is more than 10% of the market value.

Sample illustration:

Market value upon purchase in 2020: RM80,000

Under-insured for RM60,000

Market value upon damage/loss in 2022: RM70,000

Cost of damage/loss: RM10,000

Average Clause amount

You need to bear the balance of RM571

You may select the following add-ons with additional premium during quotation:

- Windscreen damage

- Car damage due to flood, windstorm, landslide and other natural disasters

- Car damage due to malicious intent, riot, strike and civil commotion

- Personal accident and medical benefits for driver and/or passengers

- Liability to passenger

- Liability to third party caused by passenger

Note: This is subject to agreement by your insurers and will incur an addition premium. The list of add-ons may be amended from time to time.

- If the accident was your fault, make an Own Damage (OD) claims

- If the accident was not your fault, make an Own Damage Knock-for-Knock (ODKFK) claim (instead of making a third-party claim)

- If your windscreen is broken, make a Windscreen claims

Follow the steps below:

- Send your car to panel repairer and hand over the relevant claim documents

- Panel repairer shall notify insurance company within 7 days of the accident

Alternatively, you may submit your claim through the RHB CLAIMS PORTAL. You may refer to the guide here.

For Own Damage (OD) claims, the required documents for filing a claim are listed below:

- Completed claim form

- Original copy of police report

- Copy of driver's and policyholder's identity card and driving licence

- Copy of car ownership certificate

- Photos of the accident scene and damages to the car

For Own Damage Knock-for-knock (ODKFK) claims, the required documents for filing a claim are listed below:

- Completed claim form

- Original copy of police report

- Copy of driver's and policyholder's identity card and driving licence

- Copy of car ownership certificate

- Photos of the accident scene and damages to the car

- Complete set of police documents (third party police report, police outcome, police sketch plan & keys)

For windscreen claims, the required documents are listed here.

Usually the panel repairer will assist to obtain full set of police documents.

The processing time for Own Damage claims is as follows:

- Claim offer: Within 7 working days upon receiving completed documents.

- Claim settlement: Within 8 working days upon receiving completed payment documents.

Note: Depending on the type of claim, the claims process duration may vary.

IPP is a repayment plan offered exclusively for RHB Insurance customers who purchase their policies using an RHB credit card. This plan allows you to convert your insurance premium into a 0% instalment plan. The amount shall include the stamp duty and service tax.

| Yearly Premium (RM) | Eligible Instalment Plan / Tenure |

|---|---|

| Minimum of RM500 | 6 months |

| Minimum of 1,000 and above | 6 months or 12 months |

You may select your desired instalment plan/tenure to convert the purchase into instalment payment at the payment stage to enjoy this benefit. Example of the conversion and payment structure is listed in the table below:

| Eligible Products | Yearly Premium (RM) | Eligible Instalment Plan / Tenure | Monthly Instalment (RM) |

|---|---|---|---|

| Car Insurance | 3,000 | 12 months | 250 per month x 12 months |

Note: The above Monthly Instalment payment amount is for illustration purpose only.

You can contact us through the following channels:

- Email: rhbi.general@rhbgroup.com

- Call: 1300 220 007

- WhatsApp: +6012 6031978

- Walk in: Customer Relationship Centre or RHB Insurance branches, click here for more details

An e-Invoice is a digital representation of a transaction between a supplier and a buyer. e-Invoice supplements paper or electronic documents such as invoices, credit notes, debit notes, and refund notes.

An e-Invoice contains the same essential information as traditional document, for example, supplier’s and buyer’s details, item descriptions, quantity, price (excluding tax), applicable taxes, and total amount, which records transaction data for daily business operations.

Please visit the RHB Insurance mobile app or website for step-by-step guidance during the “Get Quote” stage of your insurance purchasing journey and to perform self-service updates to request/opt in for e-Invoice.

Alternatively, please contact our Customer Relationship Centre at rhbi.general@rhbgroup.com for further assistance.Rest assured, all information you provide will be kept strictly private and confidential, and used solely for e-Invoice purposes.

Under Malaysia’s latest SST regulations, e-Invoices are required for fast, secure, and tax-compliant transactions. Please provide your information via our mobile or website as early as during the “Get Quote” stage of your insurance purchasing journey. Once submitted, your e-Invoice will be sent within 24 to 48 hours.

Important Notes:

- If you choose to opt out or do not submit the required information, we will assume that you prefer not to receive e-Invoices.

- If you request an e-Invoice later, we will only be able to issue it from the next billing cycle after your information is received.

- Backdated e-Invoices cannot be re-issued for transactions or period prior to your information submission.

The frequency of e-Invoice issuance depends on the type of services you receive from RHB:

- For Transactional services (e.g. insurance premiums), you will receive an e-Invoice for each transaction, typically aligned with your policy renewal or billing cycle.

- Additional service categories may follow different invoicing frequencies, and you will be informed accordingly.

For Individuals:

- Name

- MyKad/MyTentera ID number

- Tax Identification Number

- Passport number (optional)

- Address

- Contact number

- Email address

- SST Registration number (if applicable)

For Non-Individuals:

- Name

- Tax Identification Number

- New Business Registration Number [12 digits]

- Address

- Contact number

- Email address

- SST Registration number (if applicable)

Tax Identification Number (TIN) is a unique number issued by the Inland Revenue Board of Malaysia (LHDN) for tax purposes. You can check your TIN at:

For Individuals:

- Check your income tax return form (e.g. Form e-B or e-BE).

- Check on the MyTax Portal at https://mytax.hasil.gov.my/

- Your TIN should start with the prefix “IG”.

For Non-Individuals:

- Check your income tax return form (e.g. Form e-C, ePT, e-TC, e-CS, e-TA, e-TR, e-TF or e-TN).

- Check on the MyTax Portal at https://mytax.hasil.gov.my/

- Your TIN should start with the prefix “C/CS/D/E/F/FA/PT/TA/TC/TN/TP/TR/J/LE”.

Currently, you may only purchase a comprehensive motorcycle insurance policy (also known as a first-party policy) on our website and app which provides the following coverage:

- Death or injury to other parties

- Damage to other parties’ property

- Loss/damage to your motorcycle due to theft or fire

- Damage to your motorcycle due to an accident

To purchase other types of motor insurance coverage (i.e. third-party, third-party fire and theft), you can contact us through the following channels:

- Meet our authorised intermediary (i.e. Agent, General Insurance Specialist)

- Visit the nearest RHB Insurance and Bank branches, click here for more details

- Call us at 1300 220 007

- WhatsApp us at +6012 6031978

- Email us at rhbi.general@rhbgroup.com

RHB Motorcycle Insurance provides insurance against liabilities to other parties for injury or death, damage to other parties’ property and accidental or fire damage or theft of your motorcycle. Our key benefits include:

- Enjoy lower premium up to 30% from motor tariff (subject to underwriting guidelines)

- Enjoy a 10% rebate with every policy purchase

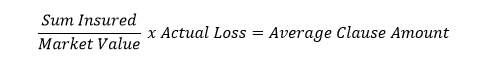

If the sum insured of your motorcycle is less than the market value (underinsured) at the time of the loss, we will apply the Average Clause which means we will only bear part of the loss in proportion to the difference between the market value and the sum insured as per the formula below:

The balance will be borne by you. This will only apply if the under-insurance amount is more than 10% of the market value.

For example:

Market value upon purchase cover note in 2024: MYR 10,000

Cover note sum insured in 2024: MYR 7,000 (Underinsured)

Market value upon damage/loss in 2024: MYR 8,000

Cost of damage/loss: MYR 6,000

Average Clause amount calculation as such: MYR 7,000/MYR 8,000 x MYR 6,000 = MYR 5,250

You need to bear the balance of MYR 750.

You may select the following add-ons with additional premium during quotation:

- Personal accident and medical benefits for rider and/or pillions

Note: This is subject to agreement by your insurers and will incur an additional premium. The list of add-ons may be amended from time to time.

- If the accident was your fault, make an Own Damage (OD) claim.

- If the accident was not your fault, make an Own Damage Knock-for-Knock (ODKFK) claim (instead of making a third-party claim).

Follow the steps below:

- Send your motorcycle to your preferred repairer and hand over the relevant claim documents.

- The repairer shall notify insurance company within 7 days of the accident via Merimen system or email to motorcycleclaim@rhbgroup.com .

Alternatively, you may submit your claim through the RHB CLAIMS PORTAL. You may refer to the guide here.

For Own Damage (OD) claims, the required documents for filing a claim are listed below:

- Completed claim form

- Original copy of police report

- Copy of rider's and policyholder's identity card and driving licence

- Copy of motorcycle ownership certificate

- Photos of the accident scene and damages to the motorcycle

For Own Damage Knock-for-knock (ODKFK) claims, the required documents for filing a claim are listed below:

- Completed claim form

- Original copy of police report

- Copy of rider's and policyholder's identity card and driving licence

- Copy of motorcycle ownership certificate

- Photos of the accident scene and damages to the motorcycle

- Complete set of police documents (third party police report, police outcome, police sketch plan & keys)

To check your claim status, you may:

- Email us at rhbi.general@rhbgroup.com

- Call us at 1300 220 007

- WhatsApp us at +6012 6031978

- Visit our RHB CLAIMS PORTAL. For further information, please refer to our guide.

The processing time for Own Damage (OD) claim is as below:

- Claim offer: Within 7 business days upon receiving completed documents.>

- Claim settlement: Within 7 business days upon receiving completed payment documents.

Note: The period may vary depending on the type of claim.

You may cancel the policy at any time by contacting us at 1300 220 007, sending a WhatsApp message to +6012 6031978 or provide a written notice 14 days in advance. The cancellation will be effective on the date we receive the notice or the date specified in the notice, whichever is earlier.

You’re entitled to a partial refund provided you haven’t made a claim on the policy. However, you won’t be eligible for a refund if you cancel your policy after 8 months.

An e-Invoice is a digital representation of a transaction between a supplier and a buyer. e-Invoice supplements paper or electronic documents such as invoices, credit notes, debit notes, and refund notes.

An e-Invoice contains the same essential information as traditional document, for example, supplier’s and buyer’s details, item descriptions, quantity, price (excluding tax), applicable taxes, and total amount, which records transaction data for daily business operations.

Please visit the RHB Insurance mobile app or website for step-by-step guidance during the “Get Quote” stage of your insurance purchasing journey and to perform self-service updates to request/opt in for e-Invoice.

Alternatively, please contact our Customer Relationship Centre at rhbi.general@rhbgroup.com for further assistance.Rest assured, all information you provide will be kept strictly private and confidential, and used solely for e-Invoice purposes.

Under Malaysia’s latest SST regulations, e-Invoices are required for fast, secure, and tax-compliant transactions. Please provide your information via our mobile or website as early as during the “Get Quote” stage of your insurance purchasing journey. Once submitted, your e-Invoice will be sent within 24 to 48 hours.

Important Notes:

- If you choose to opt out or do not submit the required information, we will assume that you prefer not to receive e-Invoices.

- If you request an e-Invoice later, we will only be able to issue it from the next billing cycle after your information is received.

- Backdated e-Invoices cannot be re-issued for transactions or period prior to your information submission.

The frequency of e-Invoice issuance depends on the type of services you receive from RHB:

- For Transactional services (e.g. insurance premiums), you will receive an e-Invoice for each transaction, typically aligned with your policy renewal or billing cycle.

- Additional service categories may follow different invoicing frequencies, and you will be informed accordingly.

For Individuals:

- Name

- MyKad/MyTentera ID number

- Tax Identification Number

- Passport number (optional)

- Address

- Contact number

- Email address

- SST Registration number (if applicable)

For Non-Individuals:

- Name

- Tax Identification Number

- New Business Registration Number [12 digits]

- Address

- Contact number

- Email address

- SST Registration number (if applicable)

Tax Identification Number (TIN) is a unique number issued by the Inland Revenue Board of Malaysia (LHDN) for tax purposes. You can check your TIN at:

For Individuals:

- Check your income tax return form (e.g. Form e-B or e-BE).

- Check on the MyTax Portal at https://mytax.hasil.gov.my/

- Your TIN should start with the prefix “IG”.

For Non-Individuals:

- Check your income tax return form (e.g. Form e-C, ePT, e-TC, e-CS, e-TA, e-TR, e-TF or e-TN).

- Check on the MyTax Portal at https://mytax.hasil.gov.my/

- Your TIN should start with the prefix “C/CS/D/E/F/FA/PT/TA/TC/TN/TP/TR/J/LE”.

- Travel Protector Plus (One-Way Trip)- the maximum length of each insured trip is 90 consecutive days. Any subsequent trip or holiday, which commences after your return to Malaysia, is not covered.

- Travel Protector Plus (Overseas Trip) – the maximum length for each insured trip is 185 consecutive days from the commencement of travel.

Our comprehensive travel insurance protects you against the costs and risks of traveling locally or internationally. Our key benefits include:

- Instant 25% rebate via online and mobile application

- Medical Expenses up to RM500,000 (including overseas COVID-19 coverage)

- Luggage damage, up to RM10,000

- 24-hour travel and medical assistance worldwide

- Covers individual and spouse at a discounted premium

- Accidental death and permanent disablement, up to RM300,000

- Emergency evacuation and repatriation, up to RM3 million

The coverage for overseas travel begins 24 hours prior to the insured person's departure from Malaysia. The coverage will end on the earliest of the following events:

- Completion of 185 consecutive days from the start of the trip

- Expiry date of the insurance policy

- 24 hours from the time of arrival back to Malaysia

- Date of emergency medical evacuation or repatriation of mortal remains back to Malaysia

- Any subsequent trip or holiday that begins after your return to your home is not covered

If your belongings are pick-pocketed while you're traveling overseas, here's what our coverage includes: We will reimburse you for reasonable additional costs related to accommodation, travel expenses, and communication expenses that are necessary for obtaining replacements for your lost passport, visa, or travel documents during your trip. However, there are certain conditions to keep in mind:

- You need to exercise reasonable care for the safety of your belongings.

- You must report the loss to the police within 24 hours of discovering it.

Our coverage does not apply if the loss is due to:

- Leaving your passport and travel documents unattended in a public place or failing to take necessary precautions to safeguard them

- Losing your passport and travel documents while they were in a suitcase that was out of your control during transit

- Leaving your passport and travel documents unattended in a public place or in your suit/jacket while they were out of your control during transit

- Damage to your passport and travel documents while they were in the custody of an airline or other carrier, unless immediately reported and a property irregularity report obtained (in the case of an airline)

- Additional expenses incurred for replacing lost passports and travel documents in your home country

- Unexplained disappearances

In case you are unable to travel, we do offer refunds for flights and accommodation under the following circumstances:

- If the unfortunate circumstance arises where your trip must be cancelled due to the passing of yourself or an immediate family member.

- In the event that your trip must be cancelled because you or an immediate family member admitted to hospital due to a bodily injury or severe illness.

- If your residence is rendered uninhabitable by unforeseen natural events such as fire, storm, flood, earthquake, hurricane, tornado, or similar occurrences, leading to the necessary cancellation of your trip.

If the airline loses your baggage, it's important to report the loss to the authorities or the airline that operated your flight immediately, within 24 hours of discovering the loss.

For detailed information regarding the process and coverage, please refer to the policy wording under the section titled “Personal Luggage and Personal Effects.”

By reporting the loss promptly and referring to the specific details outlined in the policy wording, you can initiate the necessary procedures to address the issue of your lost baggage.

If you have a pre-existing illness, please note that the travel insurance policy excludes coverage for such conditions. The policy defines pre-existing conditions as any condition that you were reasonably aware of in the twelve (12) months before the policy's effective date.

Reasonable knowledge of a pre-existing condition includes the following scenarios:

- You have received or are currently receiving medical treatment, diagnosis, consultation, or prescribed drugs for the condition.

- A physician has recommended medical advice, diagnosis, care, or treatment for the condition.

- Clear and distinct symptoms of the condition are or were evident, or its existence would have been apparent to a reasonable person in the circumstances.

In summary, if you have a pre-existing illness that falls within these criteria, it would not be covered by the travel insurance policy.

To make a claim, please notify us as soon as you return from your trip. You can contact us through the following channels:

- Email: rhbi.general@rhbgroup.com

- Call: 1300 220 007

- Walk in: Customer Relationship Centre or RHB Insurance branches, click here for more details

- Claims portal: Click here. You may refer to the guide here.

The processing time for claims is as follows:

- Claim offer: Within 7 working days upon receiving completed documents.

- Claim settlement: Within 8 working days upon receiving duly signed acceptance and e-payment details.

Note: Depending on the type of claim, the claims process duration may vary.

An e-Invoice is a digital representation of a transaction between a supplier and a buyer. e-Invoice supplements paper or electronic documents such as invoices, credit notes, debit notes, and refund notes.

An e-Invoice contains the same essential information as traditional document, for example, supplier’s and buyer’s details, item descriptions, quantity, price (excluding tax), applicable taxes, and total amount, which records transaction data for daily business operations.

Please visit the RHB Insurance mobile app or website for step-by-step guidance during the “Get Quote” stage of your insurance purchasing journey and to perform self-service updates to request/opt in for e-Invoice.

Alternatively, please contact our Customer Relationship Centre at rhbi.general@rhbgroup.com for further assistance.Rest assured, all information you provide will be kept strictly private and confidential, and used solely for e-Invoice purposes.

Under Malaysia’s latest SST regulations, e-Invoices are required for fast, secure, and tax-compliant transactions. Please provide your information via our mobile or website as early as during the “Get Quote” stage of your insurance purchasing journey. Once submitted, your e-Invoice will be sent within 24 to 48 hours.

Important Notes:

- If you choose to opt out or do not submit the required information, we will assume that you prefer not to receive e-Invoices.

- If you request an e-Invoice later, we will only be able to issue it from the next billing cycle after your information is received.

- Backdated e-Invoices cannot be re-issued for transactions or period prior to your information submission.

The frequency of e-Invoice issuance depends on the type of services you receive from RHB:

- For Transactional services (e.g. insurance premiums), you will receive an e-Invoice for each transaction, typically aligned with your policy renewal or billing cycle.

- Additional service categories may follow different invoicing frequencies, and you will be informed accordingly.

For Individuals:

- Name

- MyKad/MyTentera ID number

- Tax Identification Number

- Passport number (optional)

- Address

- Contact number

- Email address

- SST Registration number (if applicable)

For Non-Individuals:

- Name

- Tax Identification Number

- New Business Registration Number [12 digits]

- Address

- Contact number

- Email address

- SST Registration number (if applicable)

Tax Identification Number (TIN) is a unique number issued by the Inland Revenue Board of Malaysia (LHDN) for tax purposes. You can check your TIN at:

For Individuals:

- Check your income tax return form (e.g. Form e-B or e-BE).

- Check on the MyTax Portal at https://mytax.hasil.gov.my/

- Your TIN should start with the prefix “IG”.

For Non-Individuals:

- Check your income tax return form (e.g. Form e-C, ePT, e-TC, e-CS, e-TA, e-TR, e-TF or e-TN).

- Check on the MyTax Portal at https://mytax.hasil.gov.my/

- Your TIN should start with the prefix “C/CS/D/E/F/FA/PT/TA/TC/TN/TP/TR/J/LE”.

Who can apply for this policy?

An e-Invoice is a digital representation of a transaction between a supplier and a buyer. e-Invoice supplements paper or electronic documents such as invoices, credit notes, debit notes, and refund notes.

An e-Invoice contains the same essential information as traditional document, for example, supplier’s and buyer’s details, item descriptions, quantity, price (excluding tax), applicable taxes, and total amount, which records transaction data for daily business operations.

Please visit the RHB Insurance mobile app or website for step-by-step guidance during the “Get Quote” stage of your insurance purchasing journey and to perform self-service updates to request/opt in for e-Invoice.

Alternatively, please contact our Customer Relationship Centre at rhbi.general@rhbgroup.com for further assistance.Rest assured, all information you provide will be kept strictly private and confidential, and used solely for e-Invoice purposes.

Under Malaysia’s latest SST regulations, e-Invoices are required for fast, secure, and tax-compliant transactions. Please provide your information via our mobile or website as early as during the “Get Quote” stage of your insurance purchasing journey. Once submitted, your e-Invoice will be sent within 24 to 48 hours.

Important Notes:

- If you choose to opt out or do not submit the required information, we will assume that you prefer not to receive e-Invoices.

- If you request an e-Invoice later, we will only be able to issue it from the next billing cycle after your information is received.

- Backdated e-Invoices cannot be re-issued for transactions or period prior to your information submission.

The frequency of e-Invoice issuance depends on the type of services you receive from RHB:

- For Transactional services (e.g. insurance premiums), you will receive an e-Invoice for each transaction, typically aligned with your policy renewal or billing cycle.

- Additional service categories may follow different invoicing frequencies, and you will be informed accordingly.

For Individuals:

- Name

- MyKad/MyTentera ID number

- Tax Identification Number

- Passport number (optional)

- Address

- Contact number

- Email address

- SST Registration number (if applicable)

For Non-Individuals:

- Name

- Tax Identification Number

- New Business Registration Number [12 digits]

- Address

- Contact number

- Email address

- SST Registration number (if applicable)

Tax Identification Number (TIN) is a unique number issued by the Inland Revenue Board of Malaysia (LHDN) for tax purposes. You can check your TIN at:

For Individuals:

- Check your income tax return form (e.g. Form e-B or e-BE).

- Check on the MyTax Portal at https://mytax.hasil.gov.my/

- Your TIN should start with the prefix “IG”.

For Non-Individuals:

- Check your income tax return form (e.g. Form e-C, ePT, e-TC, e-CS, e-TA, e-TR, e-TF or e-TN).

- Check on the MyTax Portal at https://mytax.hasil.gov.my/

- Your TIN should start with the prefix “C/CS/D/E/F/FA/PT/TA/TC/TN/TP/TR/J/LE”.